IRS 5558 Extension Form

IRS 5558 Form: Guide to File Employee Plan Returns Later

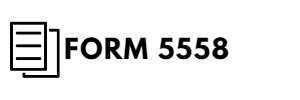

The Internal Revenue Service (IRS) utilizes various forms to gather essential information, one of which is Form 5558. This document primarily aids in requesting an extension for specific tax-related filings, typically concerning pension and benefits plans. To ensure accuracy when completing this application, one must follow the instructions for Form 5558 provided by the IRS. This guidance allows individuals and businesses to adhere to proper filing procedures and promptly meet deadlines.

A reliable resource for assistance in this process is our website, 5558-form.com, as it provides an easily accessible Form 5558 PDF. Users can find valuable materials on this platform, including instructions, examples, and even a sample of Form 5558, significantly simplifying the application completion process. By leveraging these resources, filers can better comprehend the required information, ultimately ensuring a seamless and error-free submission. Overall, our website is an invaluable tool in bridging the knowledge gap and promoting transparency in matters related to taxation and regulatory compliance.

IRS Tax Form 5558: Terms to Request an Extension of Time

Form 5558 to the IRS is filed by individuals who need additional time to complete specific tax filings related to retirement plans and employee benefit plans. It is essential for those looking to request an extension in the deadline for reporting requirements and plan documents.

Meet Lucy, a small business owner offering a retirement plan and healthcare benefits to her employees. She has had a busy and chaotic year, making her unable to file certain required tax returns within the standard deadline. To avoid facing penalties, Lucy needs to get 5558, which will give her the much-needed time extension. Lucy browses through the IRS website and learns she can file Form 5558 for an extension for 2022. By filling out this form, Lucy ensures her documents' timely submission while maintaining her focus on the core aspects of her business. As a responsible employer, she diligently completes the extension application, solidifying her commitment to her employees' well-being and the importance of transparency with the IRS.

Form 5558 PDF: From Filling to Submitting

Filling out the IRS 5558 form can seem daunting, but with proper guidance, it needn't be a challenging task. The application requests an extension of time for plan administrators, employers, and certain foreign plans to file required returns or information with the Internal Revenue Service. To ensure a smooth process without hiccups, follow these four essential steps.

IRS Form 5558: Fillable VS Printable

Navigating the complex world of taxation can be daunting, but with appropriate tools such as Form 5558 for an extension, taxpayers can efficiently manage their tax obligations. The printable version of this form offers several advantages, including tangible access to the document for records and visual aid in understanding the instructions. Additionally, this format permits the seamless transfer of essential information through the physical document.

For tech-savvy individuals, there's another option: IRS Form 5558 fillable, which allows electronic submission. This approach presents multiple benefits, primarily the time-saving aspect of immediate digital delivery. Online filling and filing streamline the process, eliminating the need for postage fees and minimizing the chances of lost or delayed submissions. Overall, each method has its merits.

Due Date

Filing the 5558 form should be done by the due date, which falls on the 15th day of the 5th month after the end of the plan year. To file Form 5558, it is essential to maintain accuracy and avoid providing any false information. Failure to submit the application on time or submitting fraudulent information could result in significant penalties, including monetary fines and possible disqualification of the related employee benefit plan. Ensure that you submit accurate and timely documentation to avoid unnecessary consequences.

IRS 5558 Extension Form: People Usually Ask

More About the 5558 Extension Form

Please Note

This website (5558-form.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.